Solar energy has become a major player in the global energy scene in recent years. As concerns about climate change intensify, governments, businesses, and individuals are increasingly turning to renewable energy sources. This shift has had a profound impact on solar power system manufacturing companies, leading to a surge in their stock prices. Let’s delve deeper into the key factors driving this trend, with a specific focus on solar panel manufacturing.

A. Global Warming and Environmental Awareness

The issue of global warming is urgent and requires immediate attention. Rising greenhouse gas emissions contribute to climate change, affecting weather patterns, sea levels, and ecosystems. As a result, governments worldwide are prioritizing clean energy solutions to mitigate the impact of climate change.

An eco-friendly substitute for fossil fuels is solar energy. Solar panels produce power by utilizing solar radiation while creating no hazardous emissions. There is an increasing demand for solar power systems as people become more aware of the advantages solar energy has for the environment. The stock market performance of solar companies is directly impacted by this increased interest.

B. Attractive Returns on Investment

Higher Returns Than Bank Fixed Deposits (FD)

Investors are drawn to solar power companies due to the attractive returns they offer. Consider this: while bank fixed deposits provide modest interest rates, investing in solar stocks can yield significantly higher returns. As solar technology improves and costs decline, companies become more profitable, translating into better dividends and capital gains for shareholders.

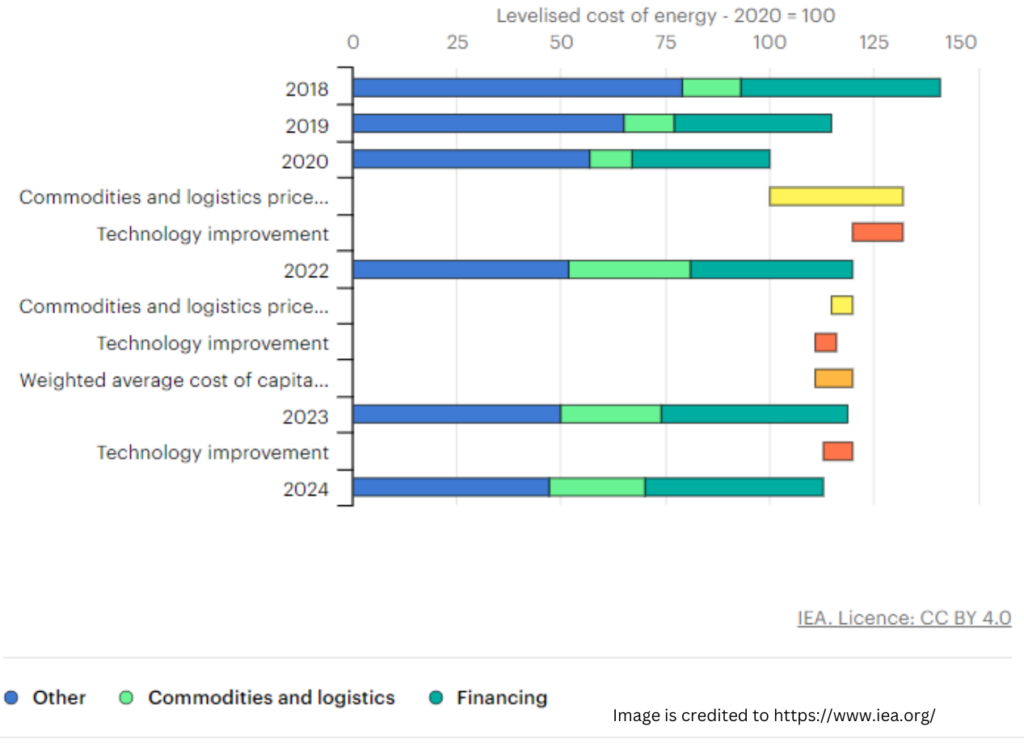

According to the International Energy Agency (IEA), the global solar photovoltaic (PV) industry has witnessed remarkable growth. In 2023, the total installed solar capacity reached >700 GW, a substantial increase from previous years. Also according to the Department of Energy’s Quarterly Solar Industry Update, global PV production in 2023 was between 400 and 500 GW. PV manufacturers have remained profitable despite global price drops across the PV supply chain. Global polysilicon spot prices fell 18% from mid-October to mid-January, approaching their lowest levels of the past several years. Global module prices reached yet another record low, falling 22% between mid-October and mid-January to $0.11/Wdc. The United States installed 15.8 GW alternating current (ac) of PV in the first nine months of 2023, a record, up 31% YoY. The percentage of U.S. electric capacity additions from solar is projected to grow from 46% in 2022 to 54% in 2023, 63% in 2024, and 71% in 2025.

C. Increasing Awareness and Adoption

Educating the Masses

Efforts to raise awareness about solar power have been successful. People now understand the advantages of solar energy, including reduced electricity bills, energy independence, and a smaller carbon footprint. As homeowners, businesses, and governments adopt solar power systems, the demand for solar products surges. Consequently, solar companies experience robust growth, reflected in their rising stock prices.

Solar Revolution

India, in particular, has witnessed a solar revolution. The government’s ambitious targets for solar capacity addition have spurred investments in solar manufacturing. As a result, Indian solar panel manufacturers have expanded their production facilities, contributing to the overall growth of the industry.

D. Property Value Enhancement

Solar Panels as an Asset

Installing solar panels on residential and commercial properties enhances their value. Buyers recognize the long-term benefits of reduced energy costs and eco-friendly living. As a result, properties equipped with solar systems command higher prices in the real estate market. This positive correlation between solar adoption and property value contributes to the bullish trend in solar company shares.

Property Value Appreciation

Studies show that homes with solar panels sell faster and at higher prices. According to a report by the Lawrence Berkeley National Laboratory, solar-equipped homes in California had a premium of around $15,000 compared to non-solar homes. This trend underscores the economic value of solar installations.

The solar power revolution is reshaping the energy sector, and solar companies are at the forefront of this transformation. As governments incentive clean energy adoption and consumers embrace solar solutions, the future looks bright for solar power system manufacturers. Investors seeking both financial returns and environmental impact are increasingly turning to solar stocks, making them a hot commodity on the stock market.

Do your homework before making any financial decisions, and keep in mind that investing always entails some risk. However, the sun seems to be shining favorably on solar power companies, and their shares continue to rise as the world embraces a greener future.